- The GTVC Publication

- Posts

- Why Venture Capital is Betting Big on EV Innovation

Why Venture Capital is Betting Big on EV Innovation

GTVC Insider: 5th Edition -- Authored by Thomas Foskey

The EV Gold Rush

Venture capital investment in electric vehicle (EV) innovation has exploded as the world transitions to clean energy. McKinsey projects the global EV market will reach $1.1 trillion by 2030, driven by strong consumer demand, government incentives, and technological breakthroughs (McKinsey & Company). But the road isn’t entirely smooth—recent reports show a slowdown in EV sales, with demand cooling due to high vehicle costs, infrastructure gaps, and reduced subsidies. The bankruptcy of Nikola Corporation in February 2025 is a stark reminder of the risks and volatility within the sector (Financial Times).

Despite these challenges, one area of the EV market is emerging as a critical focal point for investors: next-generation battery technology. While Tesla dominates the electric vehicle market, energy storage eciency, charging infrastructure, and cutting-edge battery chemistries are reshaping the competitive landscape. In fact, over $106 billion in venture funding has been invested in battery companies over the past 11 years, underscoring the massive opportunity that still exists in improving battery technology (NetZero Insights).

Betting on Batteries: The Real EV Jackpot

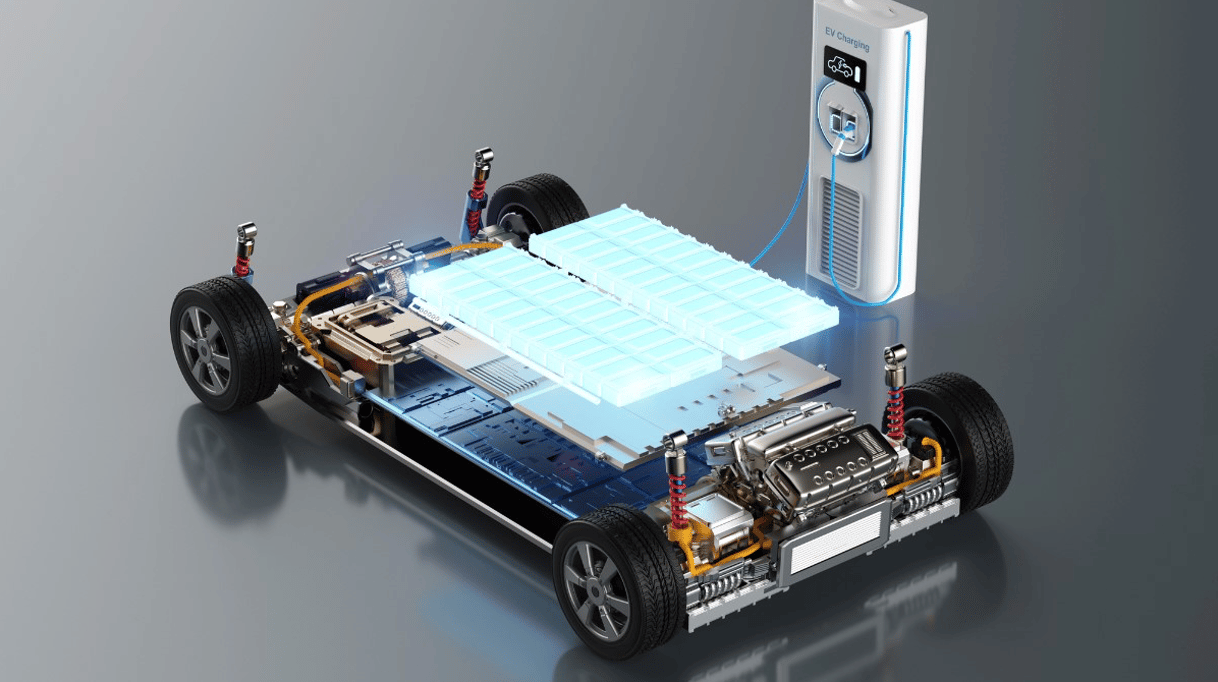

Venture capitalists are increasingly betting on battery startups because the scalability of battery production and improvements in energy storage are the biggest hurdles to widespread EV adoption. The EV market is expanding, but without a ordable, high-performance, and quickly chargeable batteries, adoption will remain constrained. Investors are looking at startups solving these bottlenecks—companies innovating in battery chemistries, fast-charging solutions, and recycling technologies are at the forefront.

For example, solid-state and lithium-sulfur batteries promise to dramatically increase energy density, lower costs, and extend driving ranges. Companies like QuantumScape, which has raised over $1.5 billion for its solid-state battery technology, are positioning themselves as key players in the next wave of EV innovation (QuantumScape).

The Gamble of Battery Innovation & the Significant Expense of Time.

Battery technology holds immense potential, but it comes with high risks. Significant R&D costs and long timelines for commercialization mean that only a fraction of battery startups will succeed. Geopolitical factors, particularly China’s dominance in rare earth minerals and battery manufacturing, could disrupt supply chains. Most recently (Feb 28th), the Trump administration is finalizing a minerals deal with Ukraine that would allocate 50% of rare earth minerals to the US. A positive look for US startups in such need, however not enough to fully compete with China producing over 60% of the worlds rare eather materials. Additionally, with the recent slowdown in consumer demand, it remains uncertain whether these startups can achieve sustainable growth amid the sector’s volatility (Financial Times).

In particular, the growing interest in electric vehicle charging infrastructure represents an untapped but rapidly growing opportunity (Utility Dive).

Big Money is in the EV game.

The landscape for EV innovation is being shaped by multiple economic forces:

● Government Incentives & Policy Support : The U.S. Inflation Reduction Act alone has allocated billions to EV manufacturing and battery supply chains, creating favorable conditions for early-stage investment. Similarly, the EU and China are aggressively promoting domestic battery production (U.S. Department of Energy).

● Breakthroughs in Battery Technology : Companies working on solid-state and lithium-sulfur batteries are generating considerable investor interest, promising major breakthroughs in energy density and cost reduction. QuantumScape’s solid-state batteries could revolutionize EV adoption by extending driving ranges and reducing charging times (QuantumScape).

Georgia Tech Startup Spotlight. Georgia Tech Research Drives the Path with cutting-edge initiatives.

● Georgia Tech Advanced Battery Center : A hub for next-gen battery development, focusing on EVs, grid energy storage, and even electric aviation (Georgia Tech Batteries Research).

● Center for Innovative Fuel Cell and Battery Technologies : A research initiative aimed at improving fuel cell durability and efficiency (Georgia Tech Research ).

● EV Smart-Charging System : A breakthrough system developed by Georgia Tech researchers to prevent grid overload while enabling faster EV charging ( Georgia Tech Research ).

These initiatives underscore Georgia Tech’s significant contributions to the EV industry, particularly in battery technology and charging infrastructure.

The US is putting its Money into Georgia Tech Professors.

Gleb Yushin, professor in the School of Materials Science and Engineering

The U.S. Department of Energy’s $100 million investment in Gleb Yushin’s EV battery startup Sila Nanotechnologies in 2022 displays strong federal interest in advancing battery technology. With a focus on improving the efficiency and longevity of batteries, Yushin’s work is a prime example of the kind of innovation attracting investor attention (Georgia Tech College of Engineering).

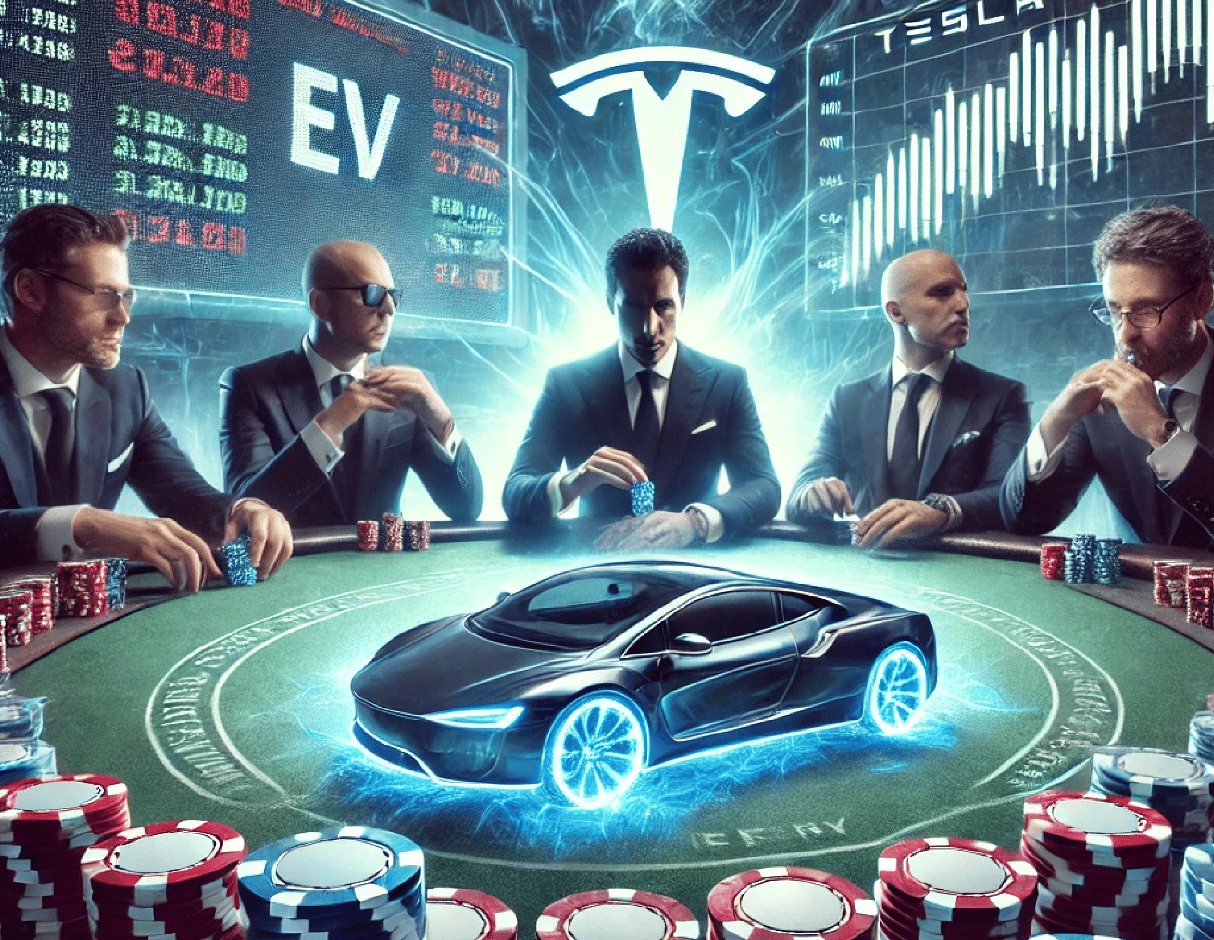

The Verdict: EV Batteries Are the High-Stakes Bet That Could Pay Out Big.

While the EV market is experiencing growing pains, battery startups and charging infrastructure innovation remain the most promising areas for venture capital. Substantial government incentives, policy support, and breakthroughs in battery technology present a compelling case for investing in this sector.

However, investors must remain cautious of the inherent risks—particularly high R&D costs and long timelines to profitability. The cooling demand for EVs and supply chain challenges create an unpredictable landscape. The strategic focus needs to be on next-generation battery tech and charging infrastructure, with the rest to fall in after these milestones have been achieved. We beleive this to be a particularly high-risk, high-reward game.

Thanks for reading this far. If you’re interested in joining GTVC or being part of one of our events, please reach out to Xander Coles at [email protected]

If you’re looking to get involved in the newsletter (student, startup, or VC), please reach out to Nils Bognar at [email protected]