- The GTVC Publication

- Posts

- The Liquidity Machine: How Secondaries Are Reshaping Private Markets

The Liquidity Machine: How Secondaries Are Reshaping Private Markets

The GTVC Publication: Edition 2 -- Authored by Krish Soni

Private markets used to reward patience. Now, they are starting to reward timing.

Everyone talks about getting into startups early. But nobody really talks about what happens when investors want out early, or at least earlier than ten years. A decade ago, if you committed money to a venture capital fund, that cash was tied up for years while the fund slowly used it to invest in startups. You would only see that money again once those startups finally exited.

Now there is a growing market built around that exact problem, opening up a way for investors to trade their stakes in private funds and companies before the big exit. Welcome to the Private Equity/Venture Capital secondaries market.

Traditionally, when you hear “secondary market”, you would probably think of Apple shares trading on the Nasdaq. In PE and VC, “secondaries” refer to investors buying and selling their existing positions in funds or private companies before an IPO or acquisition.

What used to be a niche corner of finance is now becoming an integral part of how private markets work. Secondaries are turning 10-year-long lockups of cash into planned paths to liquidity. This means investors gain control over not only how much they get paid, but when. In this market, timing beats multiples.

What Is Actually Being Traded?

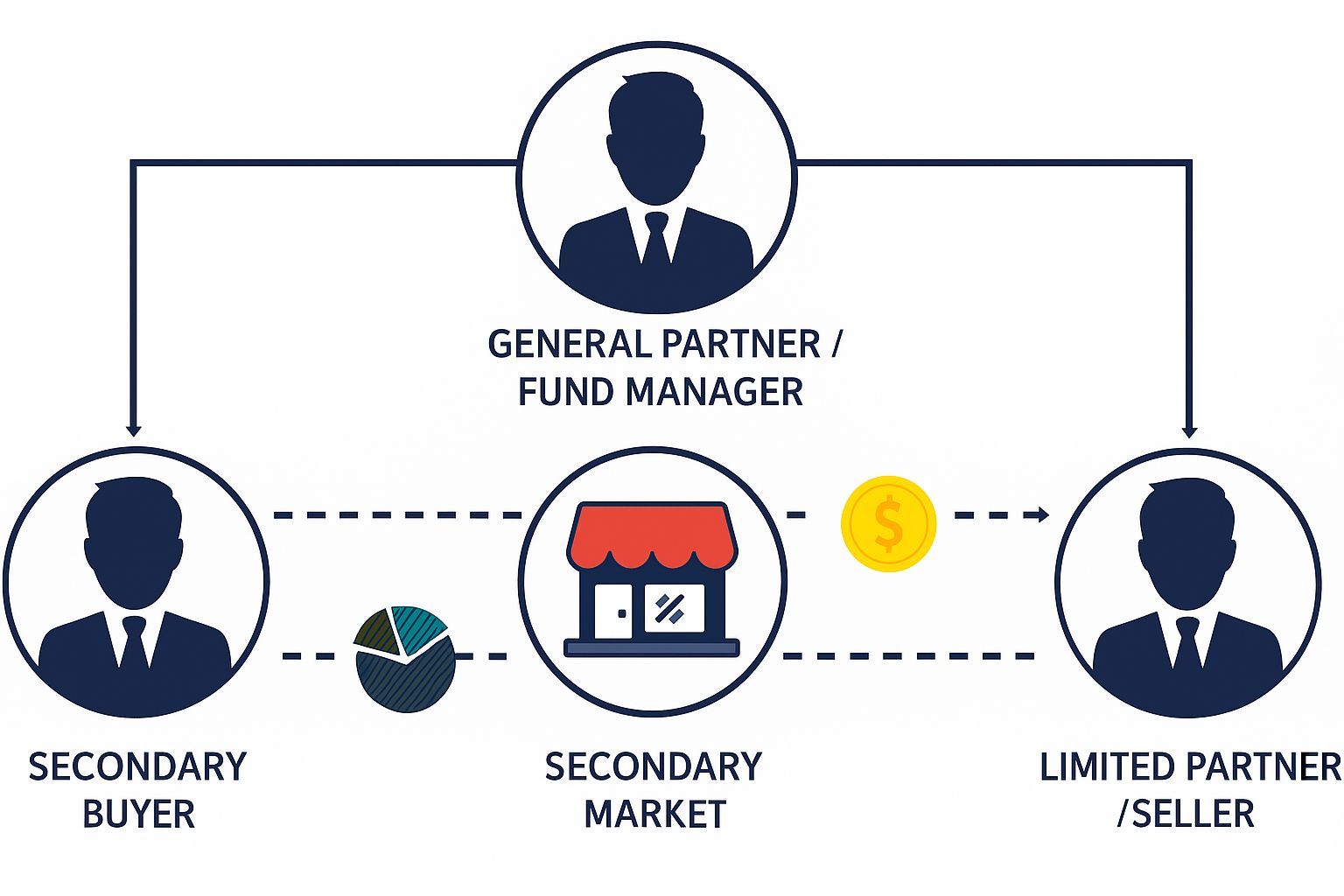

In practice, investors “trading their stakes in funds before the big exit” means an existing investor in a fund can sell their position to another investor who is willing to wait longer for the payouts. Essentially, they are selling the right to future cash flows from that fund or company.

These trades usually fall into one of 3 buckets:

LP Secondaries: Investors fully or partially sell their stake in a private fund. For example, a pension fund owns a slice of a PE/VC fund. The pension fund needs cash sooner than the private fund will naturally pay out, so it sells its stake to another investor who takes over future returns.

*LP (Limited Partner) = Passive investor who contributes capital but does not manage it.

Direct/Company Secondaries (private shares): Employees or early investors in a private company sell some of their shares in order to realize part of their gains now, while staying in for the rest.

GP-led Deals: A fund manager (the “GP”) moves one or more star companies into a new fund. Existing investors can cash out or roll their stake forward; new investors can buy in. This allows GPs to hold onto their best assets while still offering liquidity to anyone who wants out.

*GP (General Partner) = Active partner and decision maker for a fund.

The takeaway from all of this: PE/VC funds are long-term by design. When IPOs and M&A slows down, cash in these private funds get stuck. Secondaries unstick the cash.

Why IRR Beats the Headline Multiple

Two funds both double your money. Which one is better?

Fund A: Turn $100 into $200 in 3 years.

Fund B: Turn $100 into $200 in 7 years.

Same multiple, very different outcomes. The measure that captures this is IRR (internal rate of return), a return metric that factors in time, reflecting a very simple idea: getting paid sooner is more valuable than getting paid later.

Secondary buyers usually start with a target IRR (say 15%) and work backwards: “Given when we expect cash to come back, what price makes sense today?” If payouts look likely in the near future, they might pay 90% of the fund’s value. If the payout is years away or uncertain, the buyer may pay only 80% of the fund’s stated value.

The whole game comes down to this: today’s price equals future cash flows, discounted for time and risk. GP-led deals follow the same logic — if a GP moves a strong company into a new fund with a clear/guaranteed exit in a few years, buyers may pay more because the cash payout is nearer.

The Growth of PE/VC Secondaries

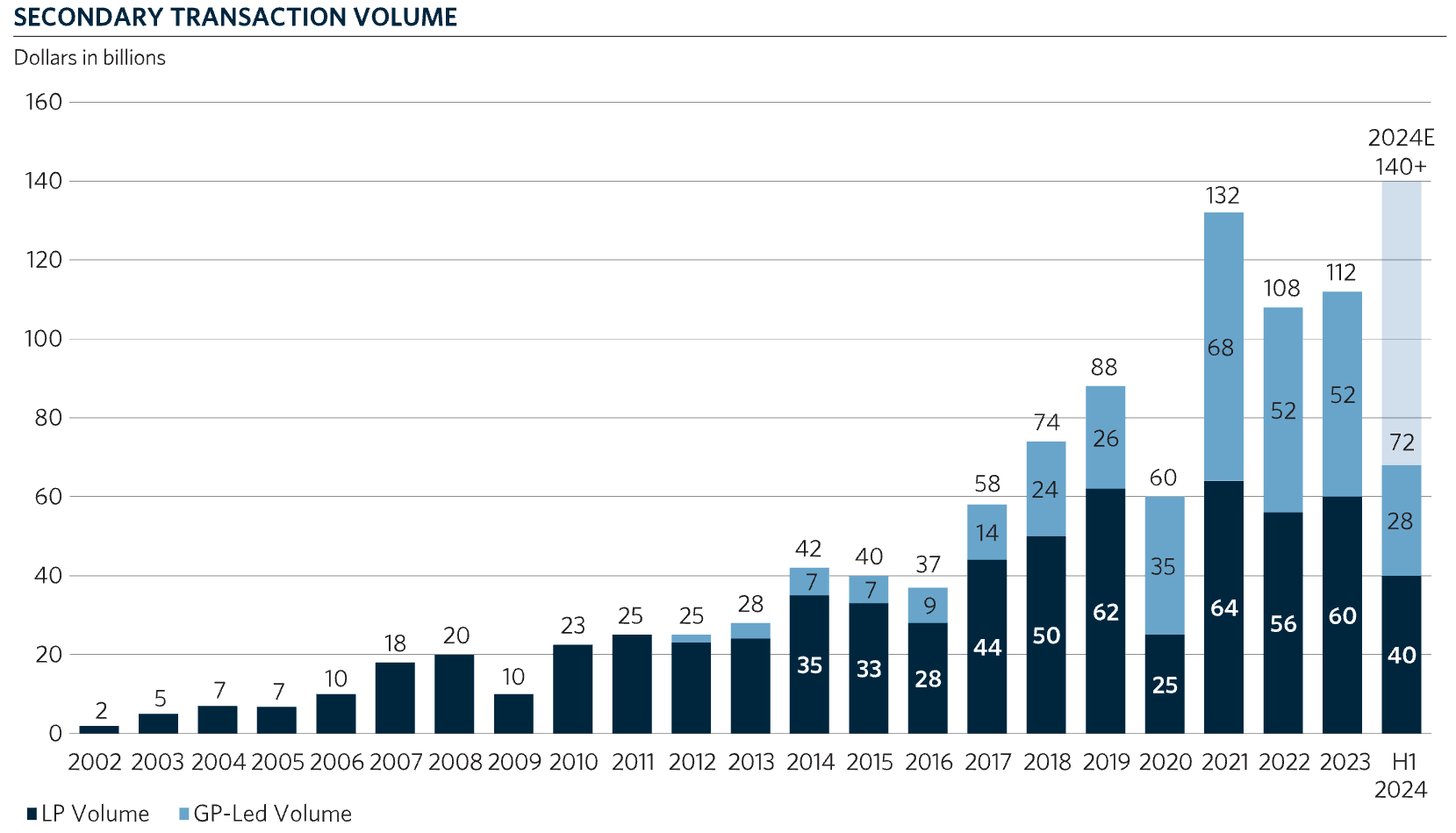

Source: Jefferies

This graph reflects Jefferies’ full-year projection for 2024, published in July 2024. The actual transaction volume for 2024 reached $162 billion.

Two major takeaways about the PE/VC secondaries market:

It’s bigger: 2024 set a new record in secondary transaction volume within private markets, meaning secondaries are not just an emergency tool anymore, they are part of normal portfolio management.

It’s broader: both LP sales and GP-led deals grew in 2024. This is not just sellers in distress, but rather managers engineering structured liquidity.

The Road to Liquidity

Private markets are becoming semi-liquid. Routine auctions and more standardized processes are making secondaries a normal part of portfolio management, not an emergency tool. The real advantage however will not come from secret deals, but rather from better forecasting of when cash payouts actually arrive, ultimately treating secondaries as a data problem, not just a narrative.

Secondaries are shifting private markets from “buy and wait a decade” to plan, price, and trade along the way. If you are an investor, stop fixating on attractive multiples and start analyzing cash timings. If you are a fund manager, paper values (reported valuations) matter less than actual, executed transactions. And if you are an investment bank advising these deals, the real product that you are selling must be a credible path to cash for investors.

Remember, in private markets, value isn’t just how much — it’s about when you get it.

Find more posts from the Georgia Tech Venture Capital Club here:

Lead Editor of The GTVC Publication: Sash Vijayakumar