- The GTVC Publication

- Posts

- Remote Work Tech: An Overlooked Sector in an AI-Dominated Era

Remote Work Tech: An Overlooked Sector in an AI-Dominated Era

The GTVC Publication: Edition 6 -- Authored by Jeff Shelton

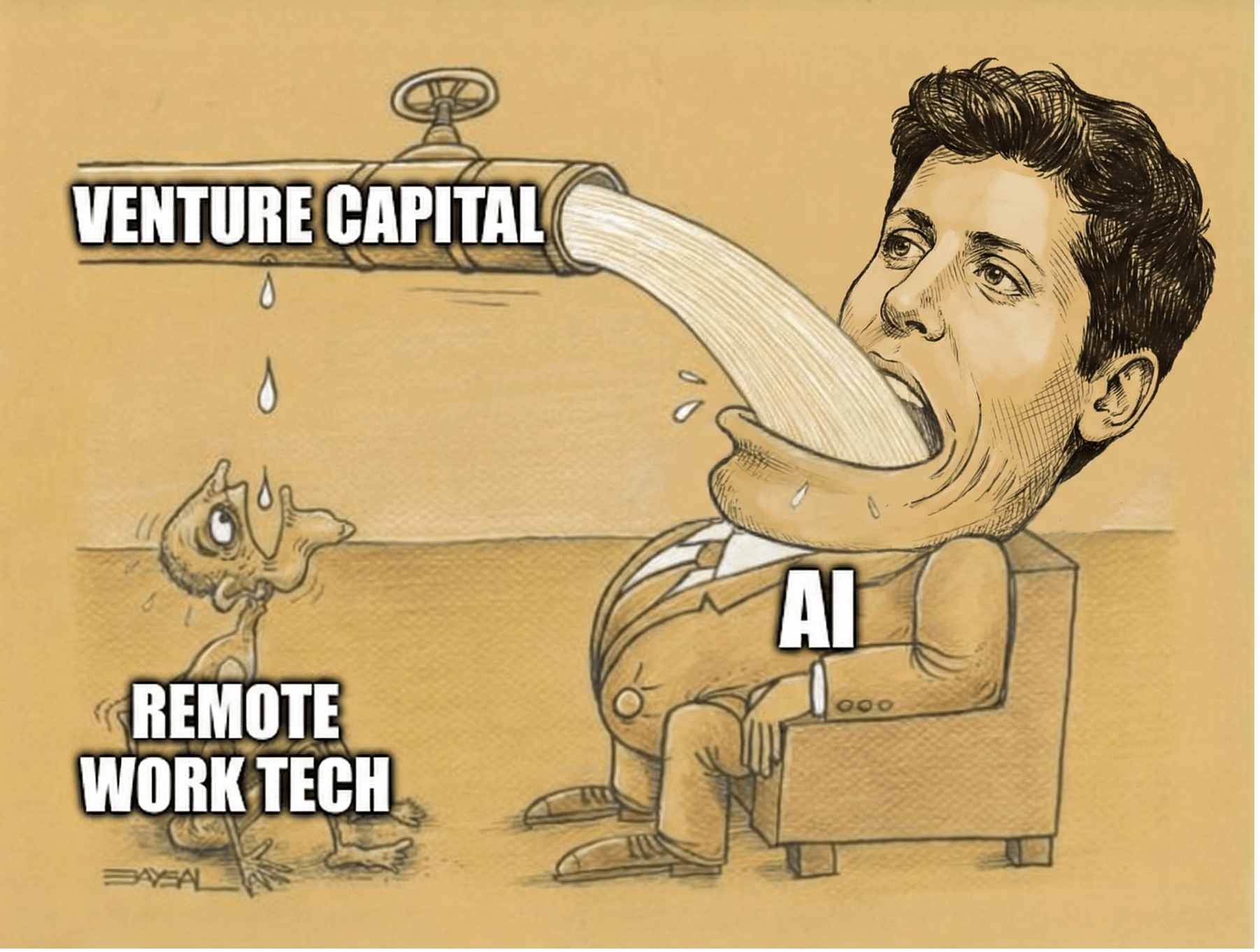

As money floods into AI, remote work technology has been quietly left behind. The result is a growing disconnect between investor sentiment and the sector’s underlying performance.

When the world went into lockdown back in 2020, white-collar work was forced to change dramatically. Companies like Zoom went from being footnotes to well-backed, billion-dollar companies with hundreds of millions of users, almost overnight. Tech behemoths pivoted in a huge way, pouring billions into remote work software platforms, like Microsoft with Teams, Meta with the MetaVerse, and Salesforce acquiring Slack.

However, over the past couple of years, we have seen a massive pullback in the amount of private investment into the remote work sector. So what changed, and why are venture capital firms abandoning this space?

A Massive Pullback

The retreat of venture capital from remote work technology companies over the past few years has been staggering. According to Acadian Ventures, over just a single year (September 2023 to September 2024):

The aggregate valuation of the companies in the Future of Work 100 list collapsed from $217 billion to $141 billion, a 38% decrease.

The number of unicorns in the remote work space fell from 64 to 40.

The median ARR (Annual Recurring Revenue) multiple fell from 19.8x to 8.6x (60% compression).

For a sector that only took off 5 years ago, a slide of this magnitude can easily be interpreted by VCs as a death knell. But should it be? This harsh environment implies that, unlike with AI companies, unprofitable companies in the remote work space do not get the benefit of the doubt.

In this space, the unit economics have to be good. There have to be real customers. Companies cannot cruise along, burning billions of dollars a quarter, and still expect to command generous valuations at ARR multiples of over 20x.

As a result of these stricter standards, capital has flowed out of the remote work technology sector. In the first half of 2025, AI captured 71% of all U.S. VC investment. Remote work technology? Just 1.7%.

Where’s the Gap?

Alright, so VC firms have stopped investing in remote work tech. What’s the big deal? This decline in investment must mean the remote work sector is saturated and the growth is slow, right? No, not at all. These markets are huge, and they’re still growing rapidly.

The remote workplace services market is estimated to grow at a 27% CAGR, surpassing $127 billion by 2030.

On the security side, the endpoint security market is estimated to grow to $35.75 billion by 2030, at a CAGR of 11%.

The U.S. Bureau of Labor Statistics estimates that for that for every 1% increase in the proportion of remote workers, total factor productivity (TFP) increases by 0.08%, meaning that remote/hybrid workers are overall more productive.

There are strong incentives for businesses to support remote/hybrid work, and executives understand this. 95% of CEOs surveyed in 2024 claimed that they had made new technology investments within the past year to improve the remote working experience. But even more tellingly, a whopping 43% claimed that this was their largest business investment of the year. That’s right, remote work tech, not AI integration.

Companies invest tremendous amounts of capital into remote work because it legitimately improves the efficiency of labor in their organization. Firms supporting hybrid work showed productivity levels 42% higher than other workspaces. So why aren’t existing players in the space able to grow?

That’s the kicker, they are. The companies in this space are healthier than ever. Take a look at some of the key venture-backed companies in the remote work sector that have been hit by the valuation crunch:

Company | ARR | YoY ARR Growth |

|---|---|---|

Deel (2025) | $1B | 75% |

NinjaOne (2023) | $500M+ | 70% |

Rippling (2025) | $570M | 30% |

1Password (2025) | $400M | 21% |

Notion (2025) | $500M | 60% |

Airtable (2024) | $478M | 27% |

Compiled from multiple different sources.

Do these companies seem stagnant? Absolutely not. They, along with many smaller players in the space, are undervalued companies growing at incredible rates.

The Future of Work

The disconnect described above reflects a broader market dynamic where the current AI frenzy has led investors to disproportionately reward AI startups, leaving strong growth companies across several other sectors irrationally overlooked and undervalued. Now, you may be asking yourself, “But Jeff, are we really going to need remote work tech when all human labor is replaced by AI?”.

Well, the reality of the matter is, if you believe in any future where human work persists (aided by AI, of course), then the further expansion of hybrid work is undeniable. Thus, companies building tools to aid remote work represent a fantastic investment opportunity at a time when capital markets have largely abandoned this fast-growing sector.

Regardless of whether there is an AI bubble, venture capital firms today are significantly under-allocating capital to remote work technology, making it one of the most overlooked opportunities in the current private market landscape.

Find more posts from the Georgia Tech Venture Capital Club here:

Lead Editor of The GTVC Publication: Sash Vijayakumar